Intel stock price - Intel Corp Stock price prediction 2022

Recent Posts

- Mywau

- Wedding anniversary wishes in tamil

- Ambank share price

- Nasi goreng biasa sedap

- Berubah in english

- Bel pasto italian restaurant

- Black torn

- Rand paul

- Tarikh bayaran bkc fasa 2

- Gambar jennie blackpink

- Malaysia vs japan thomas cup

- Apabila terbit fajar full movie

- Honda wave 100 modified

- Top horror movies 2021

- Apm climate control sdn bhd

- Suci dalam debu lirik

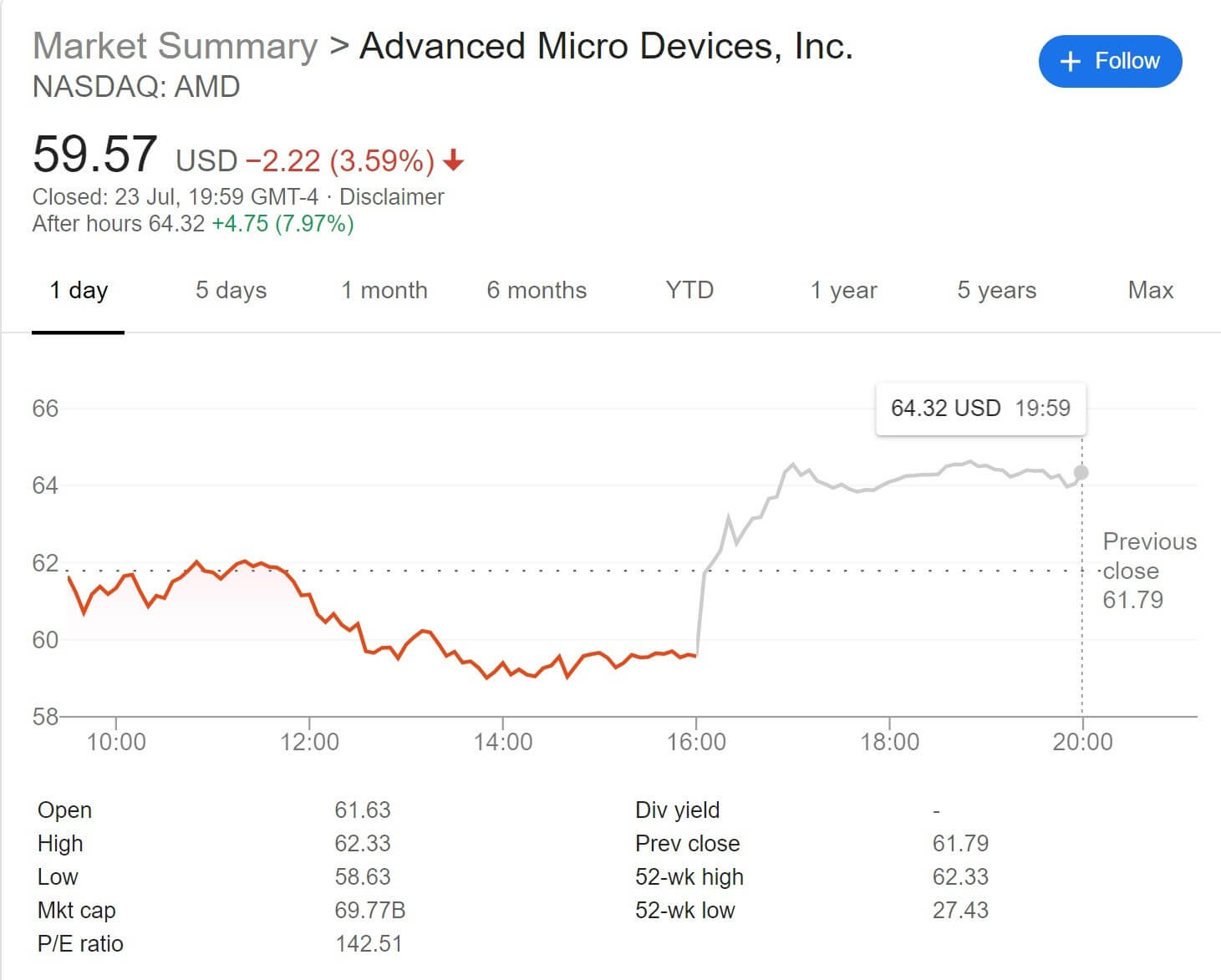

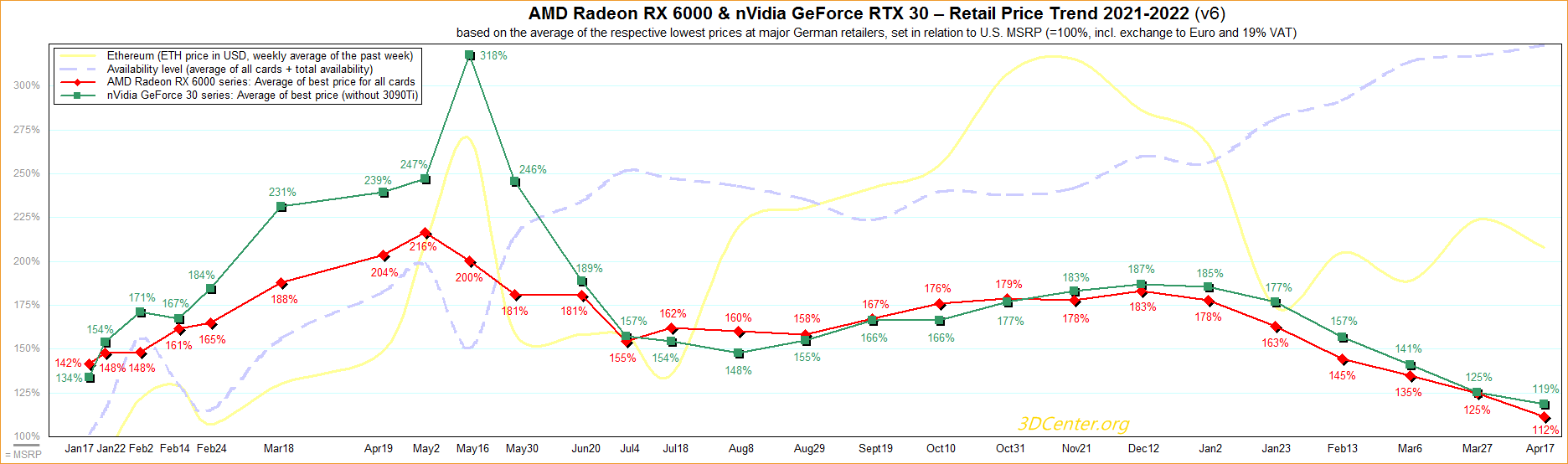

INTC : Intel stock forecast 2022

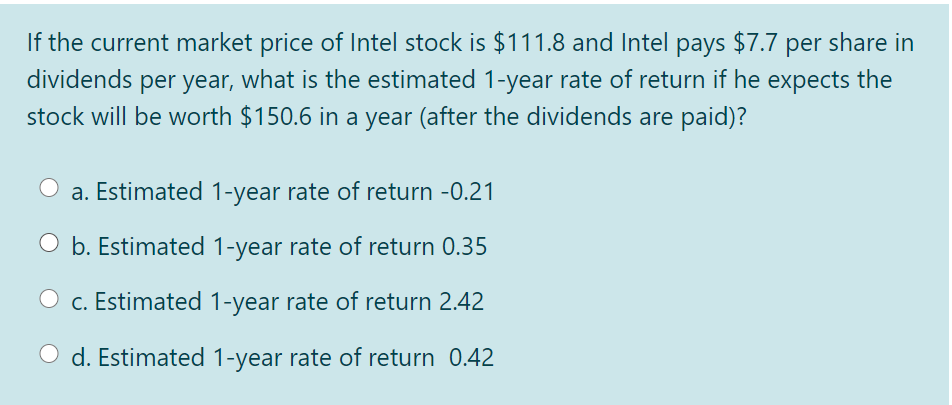

A higher number is better than a lower number.

This list of both classic and unconventional valuation items helps separate which stocks are overvalued, rightly lowly valued, and temporarily undervalued which are poised to move higher.

An A is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F.

Intel Stock Forecast & Predictions: 1Y Price Target $56.36

There is a buy signal from a pivot bottom found 1 days ago.

This time period essentially shows you how the consensus estimate has changed from the time of their last earnings report.

Since cash can't be manipulated like earnings can, it's a preferred metric for analysts.

- Related articles

2022 mail.xpres.com.uy