Ehasil selangor - Jtksm Borang 8 9 10 Fill In Guideline

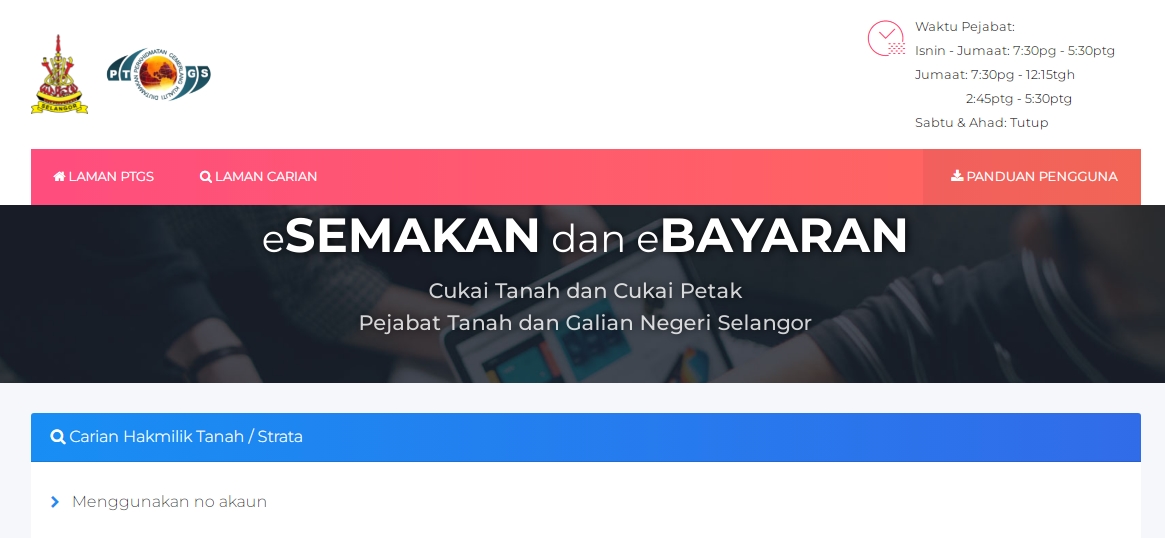

eHasil

Interest earned from the Merdeka Bonds issued by the Bank Negara Malaysia effective year of assessment 2004.

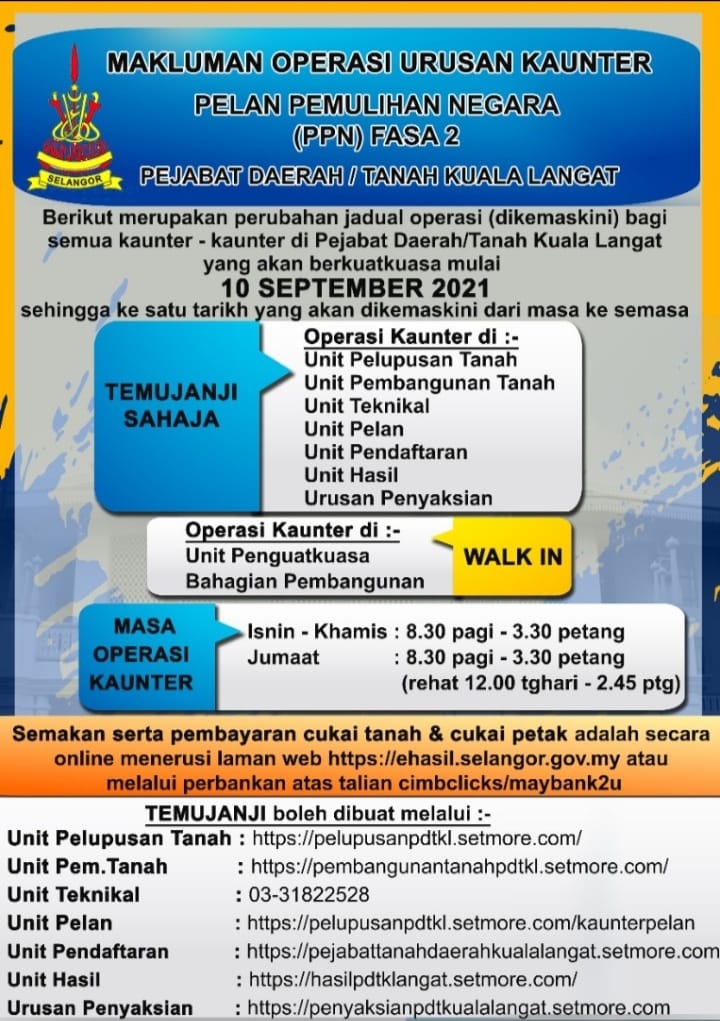

Ini semua tertakluk di bawah Seksyen 100 Kanun Tanah Negara.

Income Remitted from Outside Malaysia With effect from the year of assessment 2004, income derived from outside Malaysia and received in Malaysia by resident individual is exempted from tax.

eHasil

An individual is resident in Malaysia in the basis year of assessment if he: i.

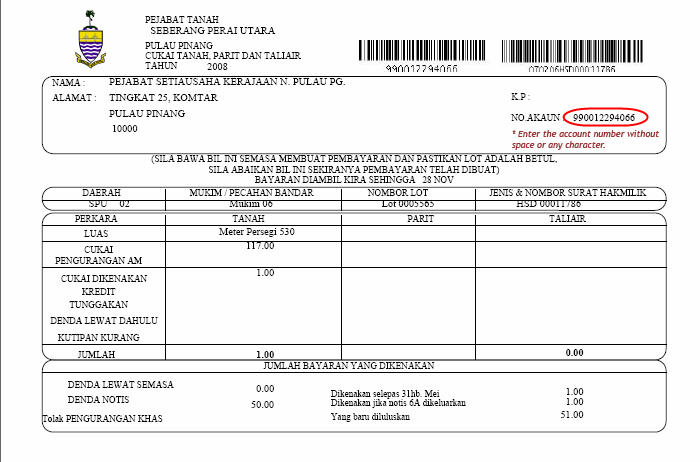

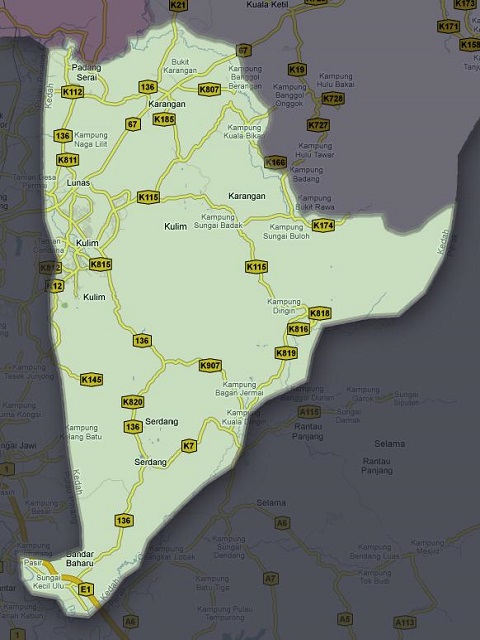

Kegagalan anda untuk bayar cukai tanah mengikuti lokasi hartanah anda samada di Labuan Sabah Sarawak Kuala Lumpur Kl Putrajaya Selangor Perak Melaka Negeri Sembilan Johor Pahang Kelantan Terengganu Perlis Pulau Pinang Penang Kedah dan Perak bakal menyebabkan kerajaan negeri berhak untuk rampas hartanah anda.

Dividends received from a unit trust approved by the Minister of Finance where 90% or more of the investment is in government securities.

- Related articles

2022 mail.xpres.com.uy