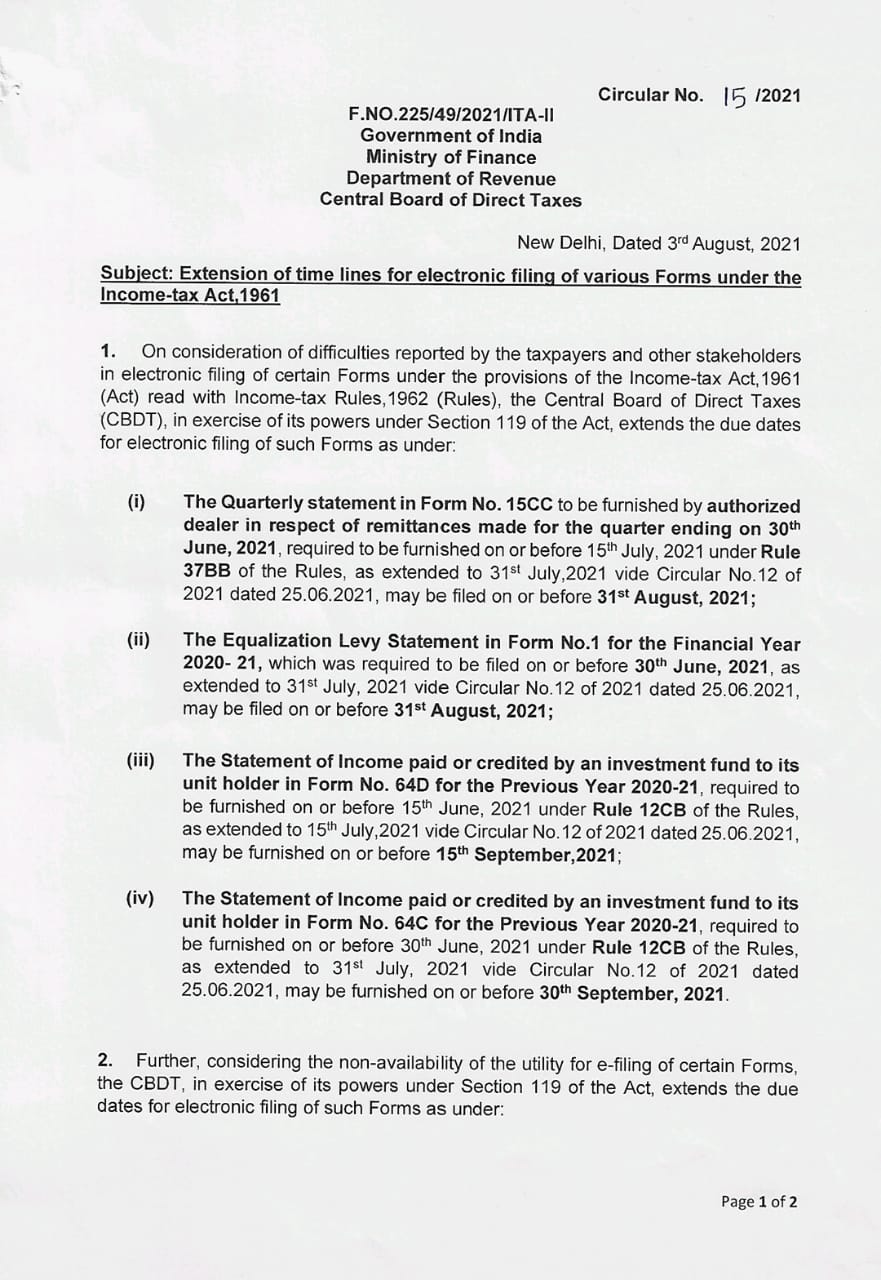

Due date for e filing 2021 - 2021 E

Recent Posts

- Arsene wenger

- Maksud nasionalisme menurut hans kohn

- Kolej sultan alaeddin suleiman shah

- Periuk yang selamat digunakan

- Rumah murah bawah 100k

- Peperomia

- Kedekut in chinese

- Kuih rengas kacang hijau

- You are the apple of my eye japanese

- Resipi bubur asyura

- 3 days of blind girl

- Find the best home loan in malaysia

- Amazon share price

- Niat buka puasa rumi

- Aiskrim yogurt llaollao

- Penghitungan wr

- Jamuan akhir tahun

- Off the road mod apk

- Standard q rapid test

- Jawatan kosong terkini 2021

Prepare And eFile Your 2021 Alabama State Income Tax Return due in 2022.

Below, find these dates for the current tax year to keep in mind.

See more on the expected in 2022.

If you miss the tax filing deadline and are owed a refund If you overpaid for the 2021 tax year, there's typically no penalty for filing your tax return late.

When are Taxes Due? Important Tax Deadlines and Dates

You can electronically with TurboTax or mail.

This form is issued by the payers of interest income to their investors at the end of the year.

Taxpayers in that area who extended their 2019 tax returns to October 15, 2020, now have until January 15, 2021 to file those returns.

- Related articles

2022 mail.xpres.com.uy