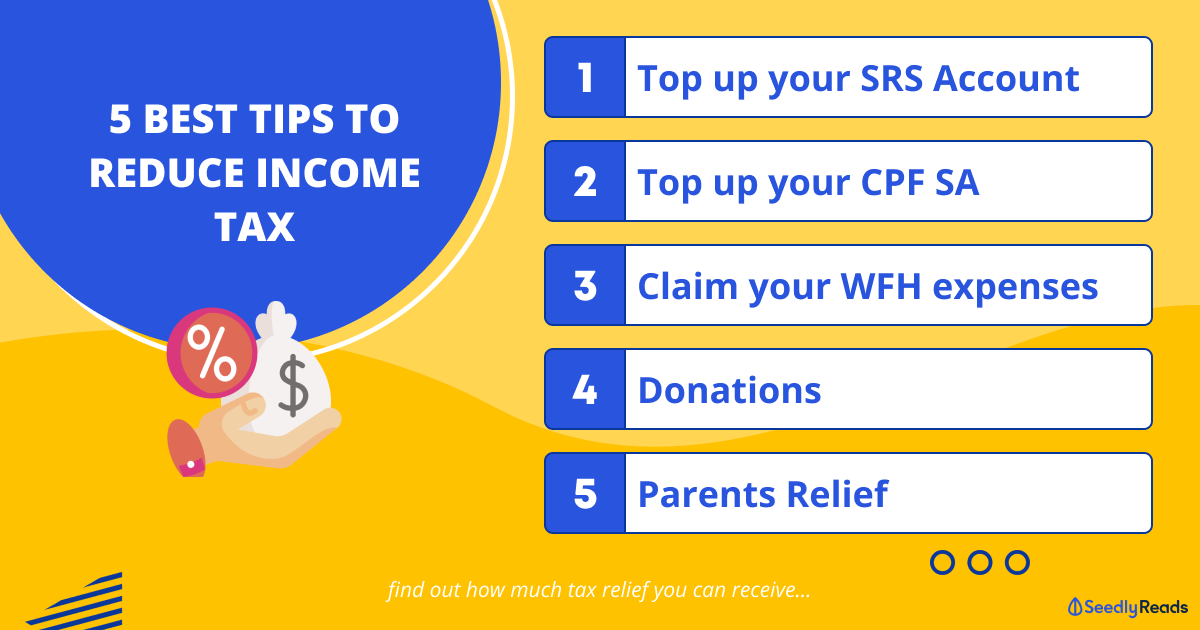

Tax relief 2021 - $1,400 third stimulus check: what is TREAS 310

$1,400 third stimulus check: what is TREAS 310

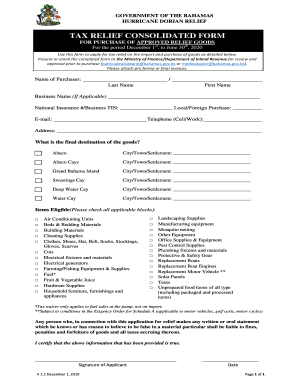

In other words, credits are based on the amount of property taxes paid in excess of 6 percent of an eligible taxpayer's federal adjusted gross income.

But not everyone will qualify for the relief as part of the state budget, which is tied to household income.

Bettencourt said laws passed three years ago will also help homeowners amid the surging market.

5 Things to Know About Property Tax Relief in New York

Despite the slowdown, statewide fraud is still ongoing.

The Associated Press contributed to this report.

When does this all take effect? Voters will also decide whether to approve adding property tax relief for seniors and Texans with disabilities.

- Related articles

2022 mail.xpres.com.uy