Sst exemption malaysia - Sales and Service Tax (SST) in Malaysia

Recent Posts

- Redux meaning

- Tengku bib

- Hsbc customer service

- Myvi 1.5 advance 2021

- Kung fu tv series

- Beige

- Jesy nelson boyfriend

- Pep guardiola

- Denai alam recreational and riding club

- Modul transisi tahun 1 2022

- Pizza hut delivery number

- Ukom upm

- Maxis ttdi

- Druig eternals actor

- Big pharmacy online delivery

- Kuih kapal terbang

- Celup tepung hujung tanjung

- Kedudukan kelayakan piala dunia 2022 zon eropah

- Intel stock price

- Resepi air cocktail soda

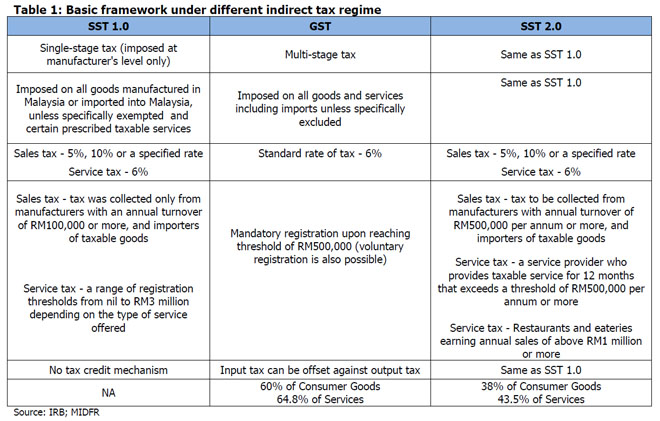

What are the SST

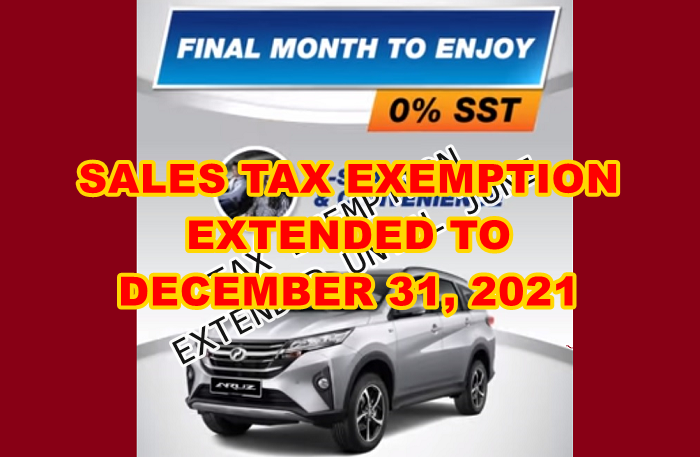

The businesses that perform their activities in Malaysia and internationally will have to pay SST if they exceed a particular annual income threshold.

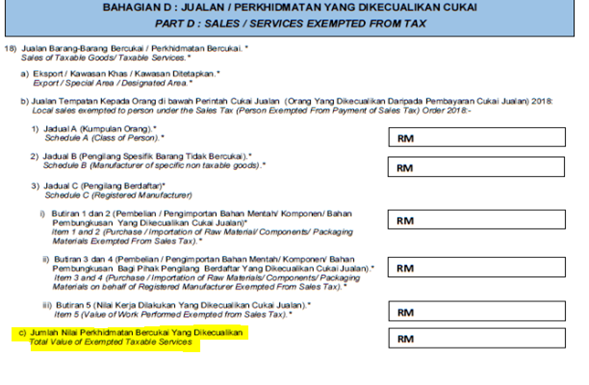

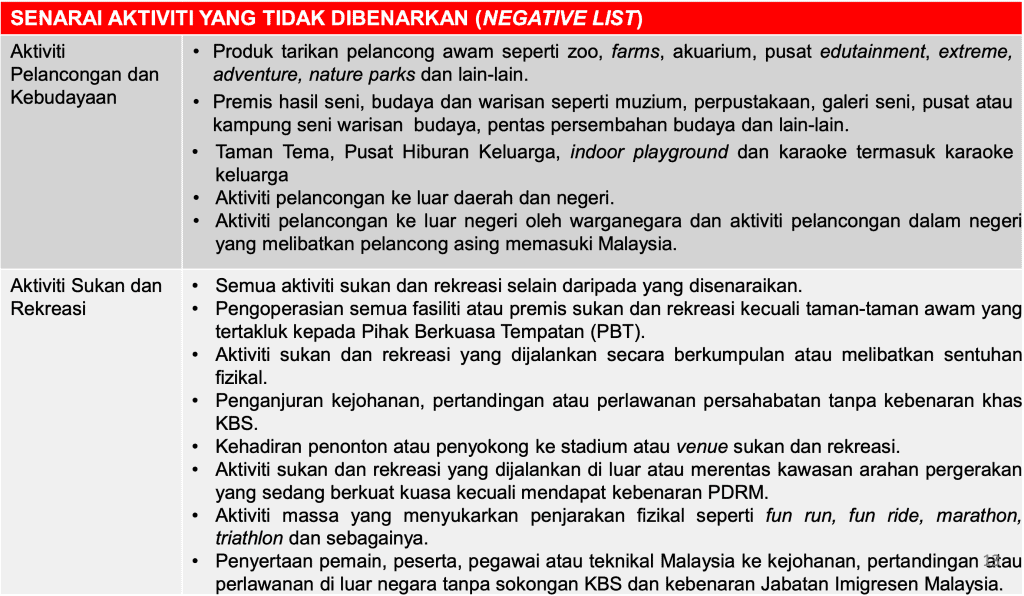

If you click on the dropdown arrow on the tax rate column, you will see different options such as: Inbuild Tariff codes under Deskera Books Goods and Person Exempted from Sales Tax Goods Exempted from Sales Tax All goods that are manufactured for export will be exempt from sales tax.

Therefore any service tax incurred by a business is a final cost.

- Related articles

2022 mail.xpres.com.uy