Dow futures index - U.S. stock futures point to rebound for Wall Street, with Microsoft, Alphabet earnings in focus

Recent Posts

- Despicable me song

- Jeff bezos superyacht

- Cyberbullying

- Dr tayar muar

- Black panther director

- Snake eyes full movie

- Allahumma aslamtu

- Zulfikar ali bhutto

- Oh nara

- Resepi biskut makmur azlina ina

- Jaya grocer online

- 4share mp3 download lagu melayu

- Sambutan kemerdekaan 2021

- Lirik permaidani

- Met malaysia ramalan cuaca

- Jenis jenis penyalahgunaan bahan

- Nilai not minim bertitik

Yahoo forma parte de la familia de marcas de Yahoo

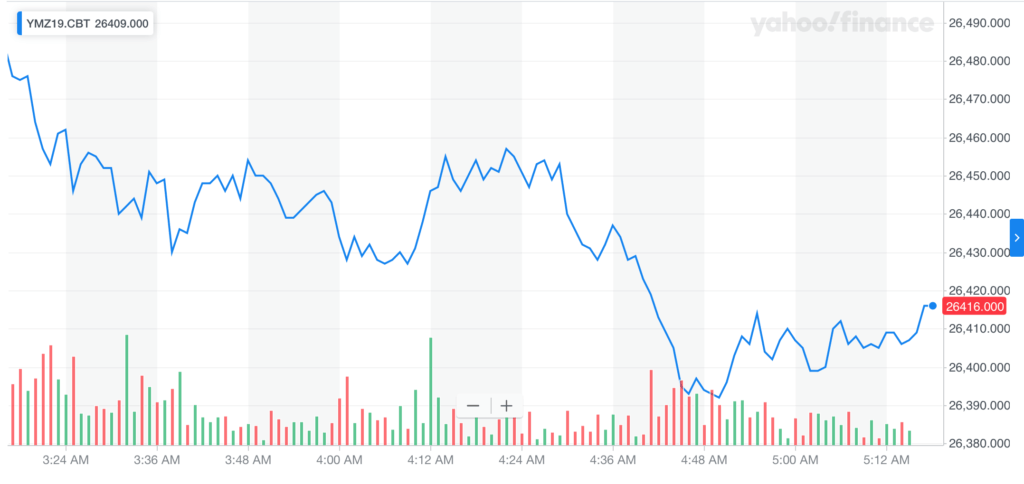

Most major brokerages such as , , and Interactive Brokers offer stock index futures.

If the market were to fall, the Dow Futures trader could lose huge sums of money.

For brevity, it is simply referred to as the Dow Jones Index and is the basis of a whole family of indexes.

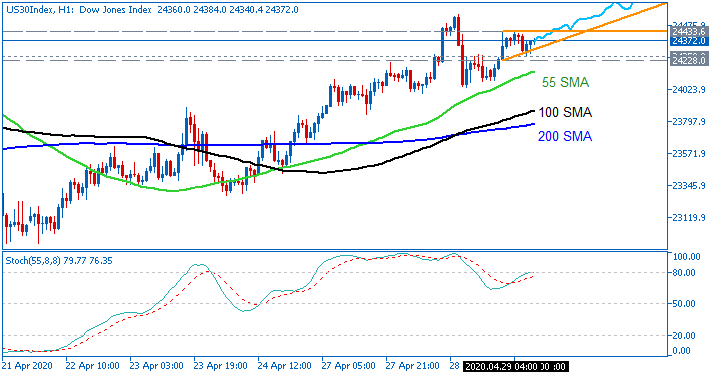

Dow Jones 30 Industrial

That simplicity, the high trading volumes, and the leverage available have made Dow futures a popular way to trade the overall U.

The market background is neutral.

For example, if you opened the trade by buying five E-mini Dow contracts, you would close the trade by selling them with the same futures contract expiration date.

- Related articles

2022 mail.xpres.com.uy